Please open this case study on a larger device

Networking that works all year round

PEI connects investors and fundraisers through conferences and events that run across the year. This project was an opportunity to extend that value into a continuous digital experience that helps members find the right people at the right time.

I led the research as well as creating and testing flows with investors and fundraisers. Insights from those sessions shaped the final product direction and informed key experience choices around trust, privacy, and the quality of matches.

Product

Investor Relations Networking Platform

Skills

Research, Wireframing, User Testing

Role

Research Lead & Concept Designer

Timeline

3 Months

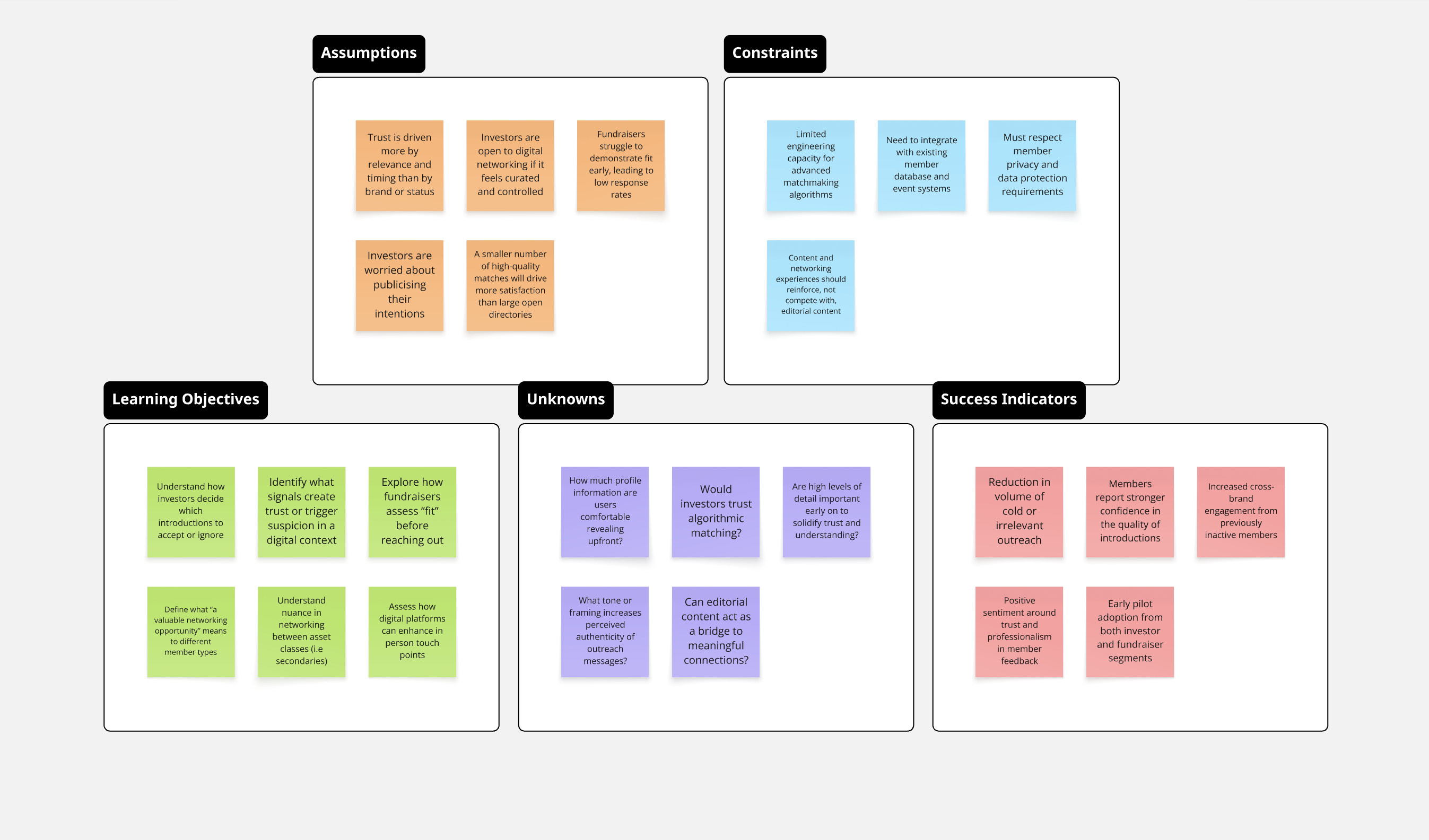

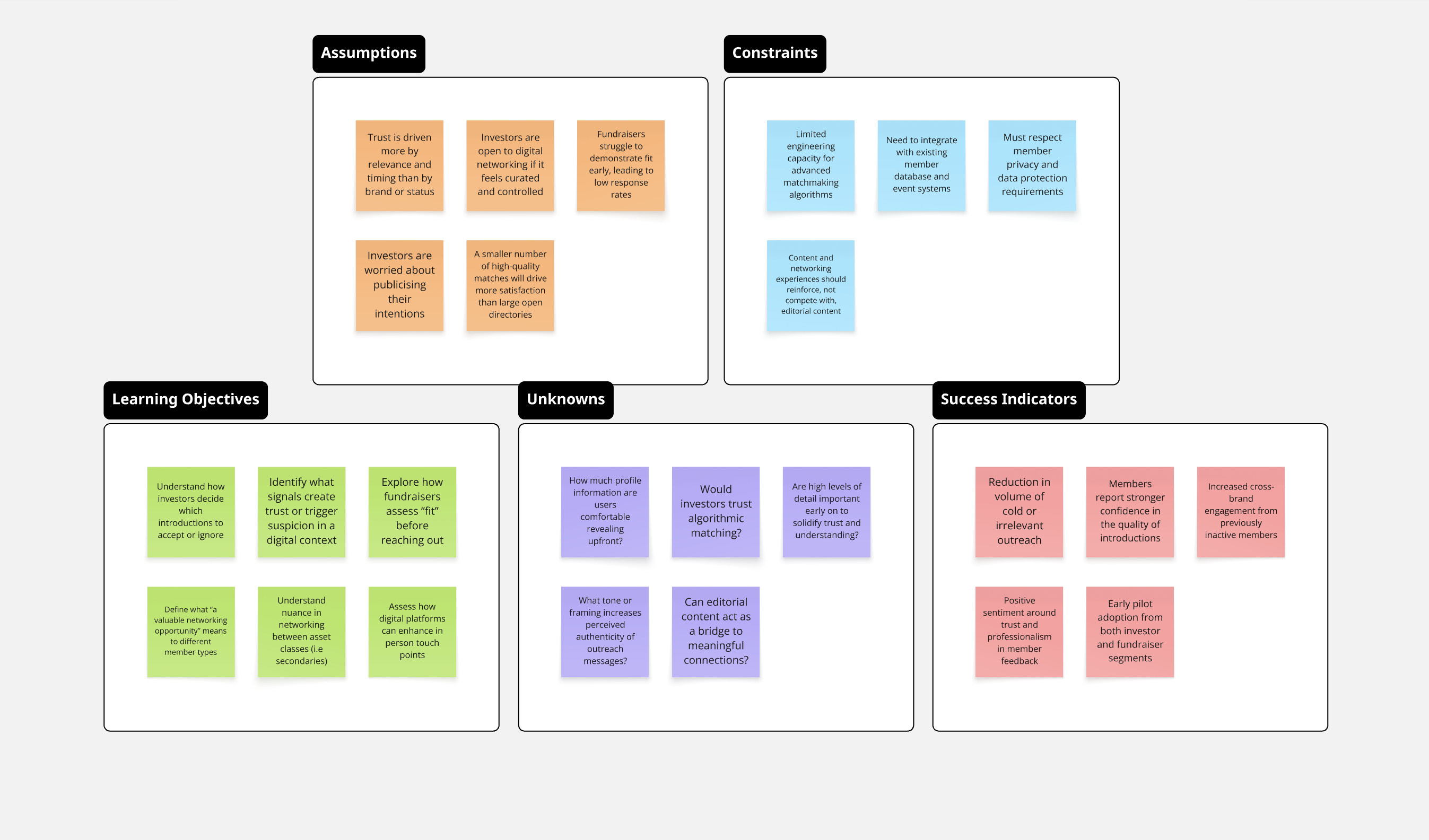

Research Planning

Before speaking with members, I aligned with product, commercial, and editorial leads to clarify business goals and constraints. We reviewed existing feedback, support tickets, and engagement data to build a shared view of the most valuable unknowns. From this, I wrote a learning plan and an interview guide focused on decision moments, signals of trust, and measures of fit.

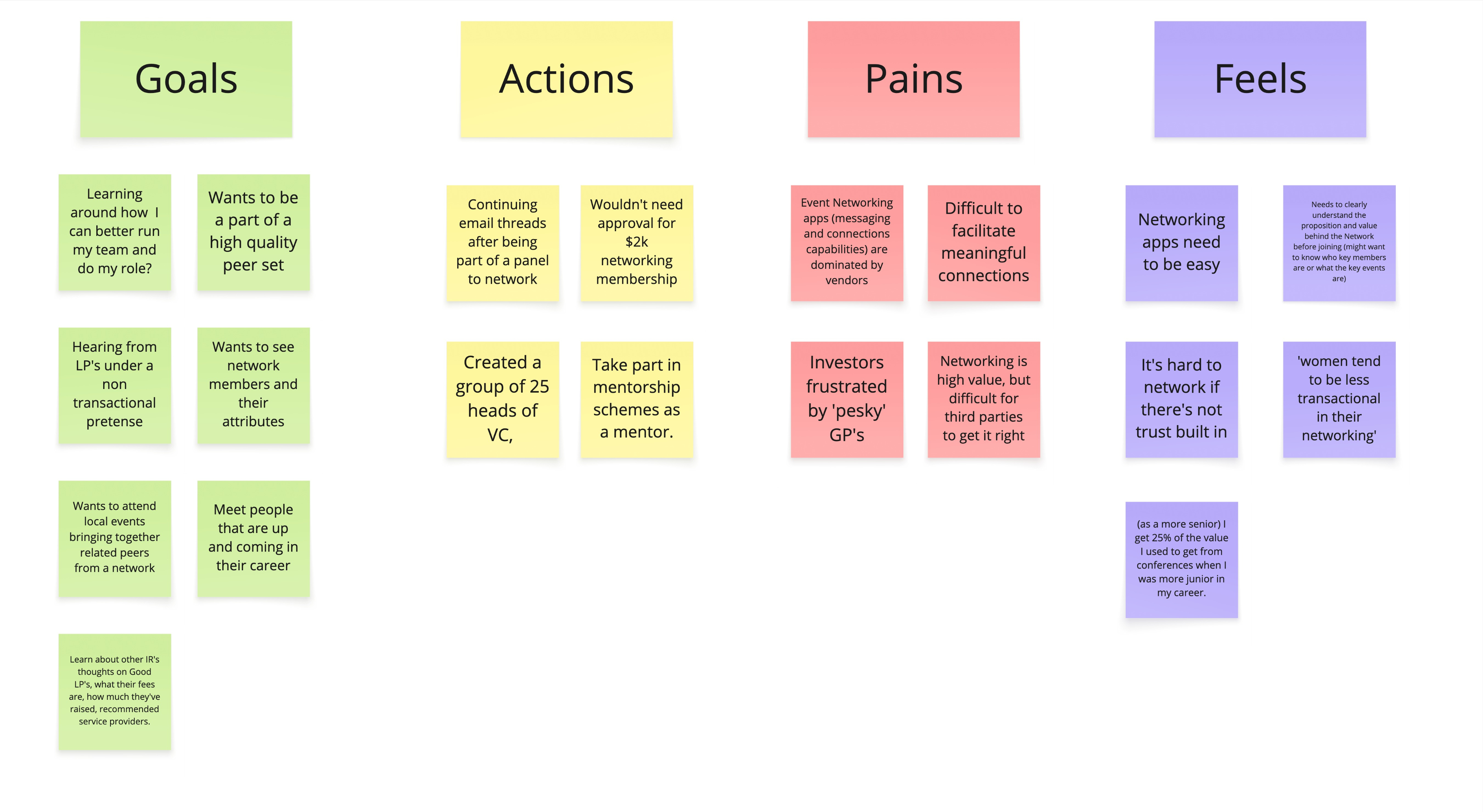

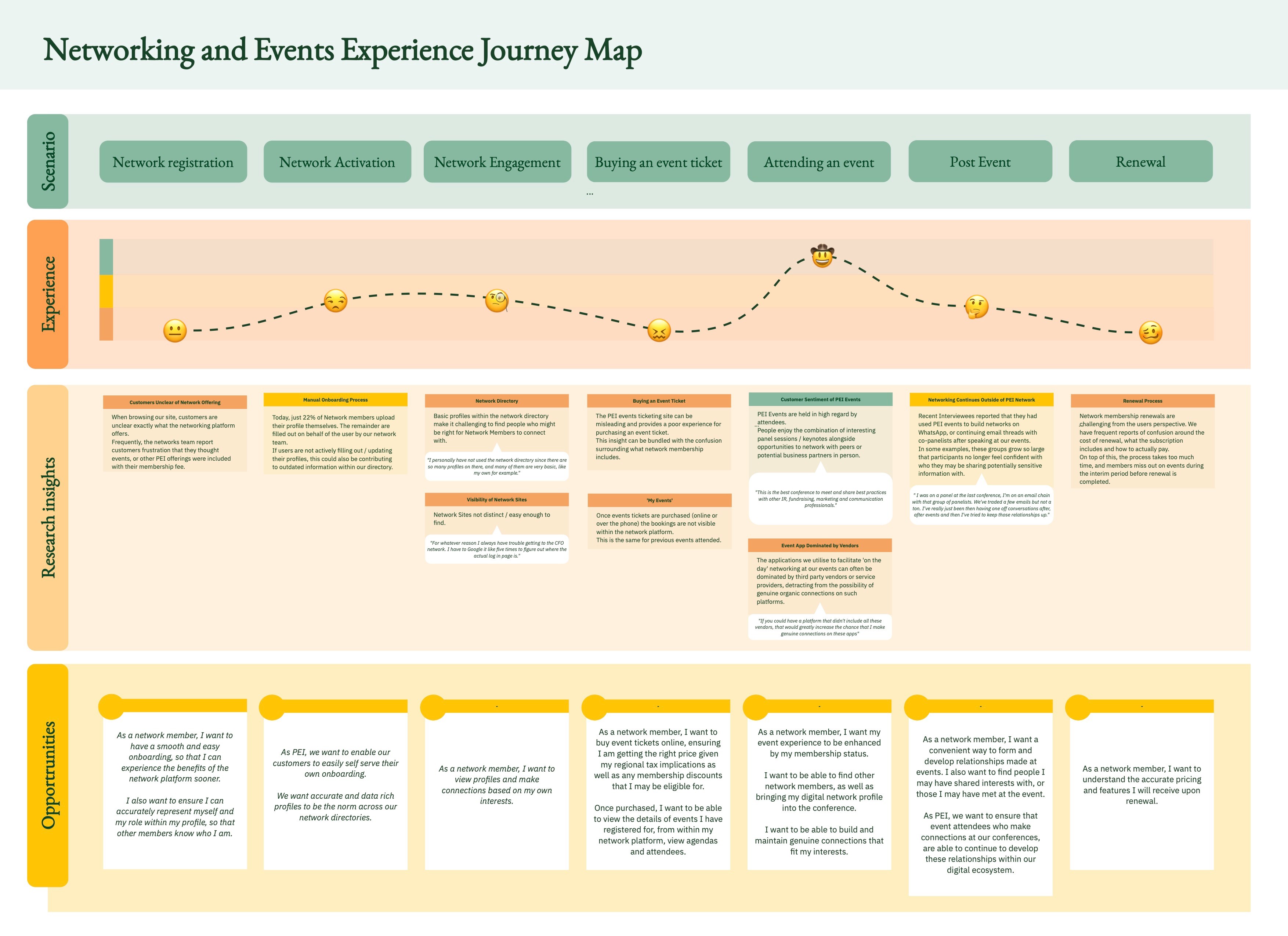

Unpacking user attitudes, and mapping current experiences

Discovery

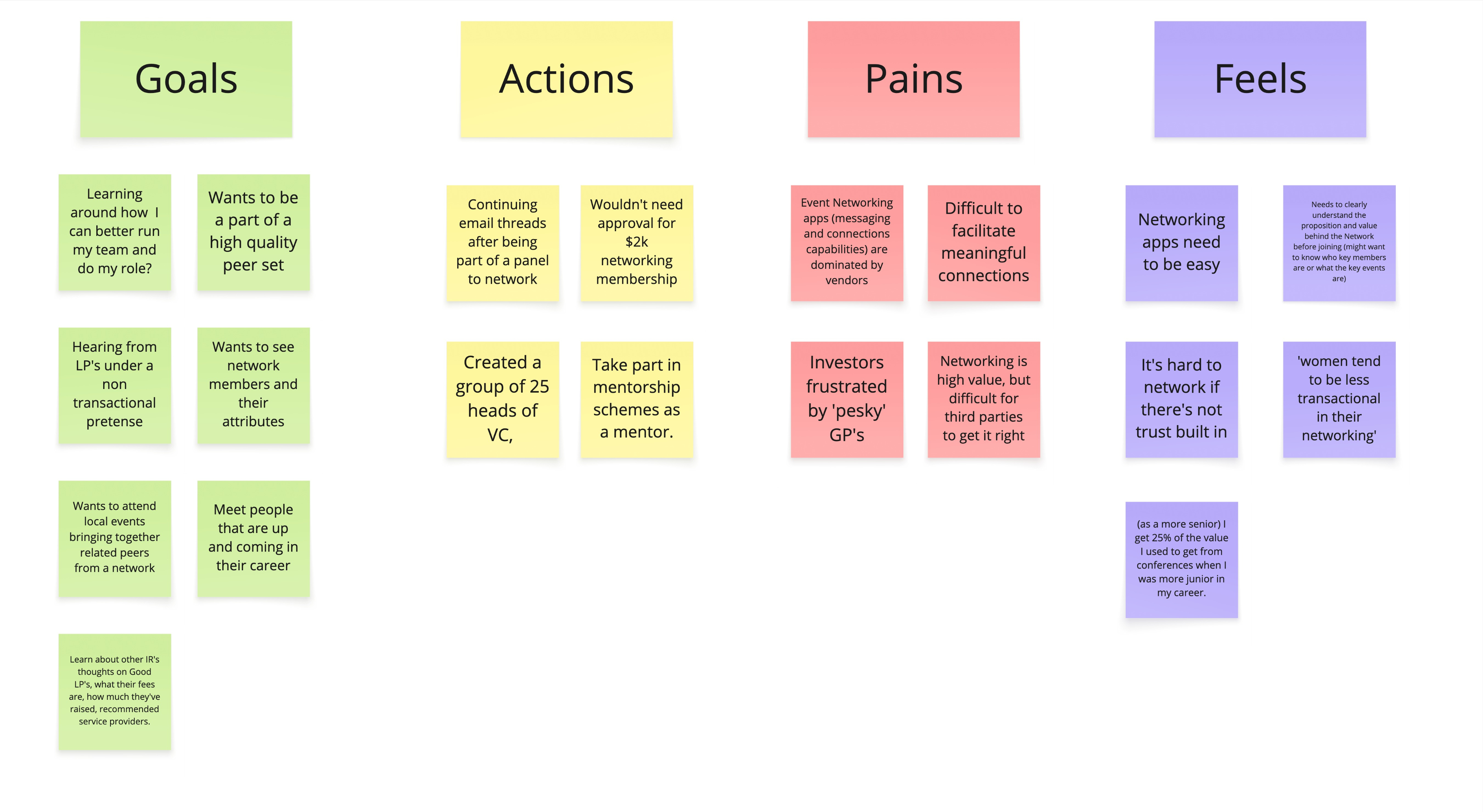

Using the plan created alongside business stakeholders, I set out to perform exploratory research to better understand the problem space.

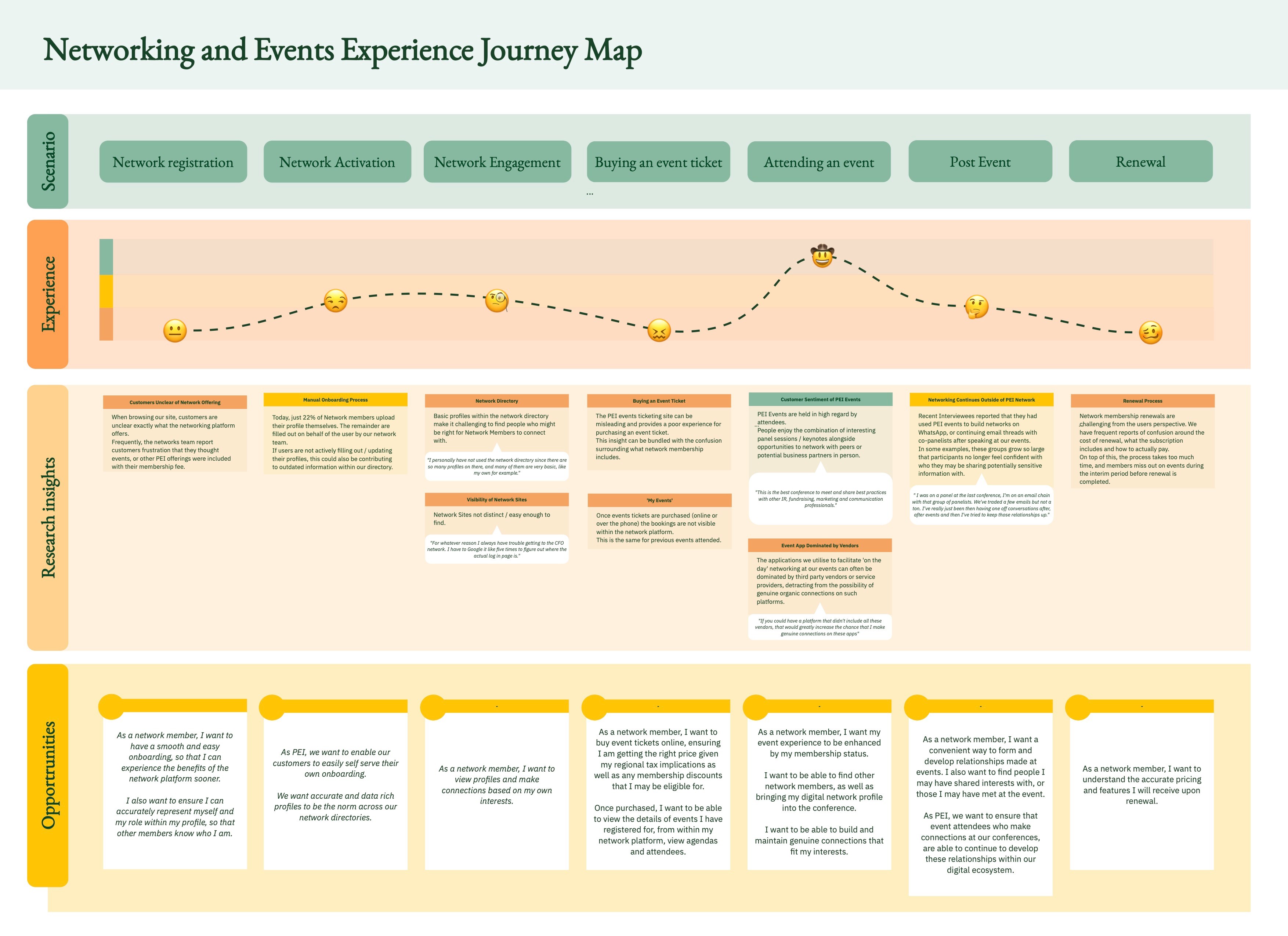

I began with field research at PEI events, conducting interviews with attendees to understand their needs before, during, and after conferences. These conversations revealed a consistent pattern: professionals highly valued the networking opportunities but felt frustrated when connections couldn't be maintained once they returned to their day to day work. One investor participant captured this sentiment perfectly: "The event is so valuable, but it feels like it all disappears once I leave the venue."

To further my in person research, I ran remote interviews with more investors and with fundraisers. Sessions focused on recent digital networking and matchmaking experiences, exploring what prompted outreach, what signalled quality, and what caused people to disengage. This allowed me to dig deeper, understanding the attitudes behind some of the behaviours captured from the events.

Key Insights:

Fit needs to be crystal clear before meetings are booked. Currently many networking apps revolve around a meeting being the first step. Investors need to see clear alignment in strategy, fund stage and geography before proceeding.

Matchmaking Fit

Volume is the core problem for investors. many are overwhelmed by outreach. They still want introductions, but they need a clear reason to engage.

Inbox Overwhelm

Privacy and control increase trust for investors. They want to share information progressively as they see appropriate to protect their investment strategy. This is a challenge for fundraisers who rely on such information to inform tailored outreach.

Privacy & Control

“There’s no such thing as a ‘re-up’ anymore, you have to earn it every single time” - Fundraiser

“Only occasionally do I feel that fundraisers do a good job of understanding us... are we a ticket, or are we a partner?” - Institutional Investor

Unpacking user attitudes, and mapping current experiences

Ideation

To begin the ideation phase, I outlined some design principles based on research findings. These helped to guide ideation, and internally assess the merits and pitfalls of different approaches.

Design principles:

With these principles in mind, early exploration involved mapping potential new journey flows based on the opportunities identified within research. These included processes to protect investors from being bombarded with connection requests from fundraisers who don’t match their investment strategy, and designing a recommendation engine to proactively ‘match’ network members based on their business goals.

FLOWS

We then started to examine how different components could be integrated to support the flows outlined.

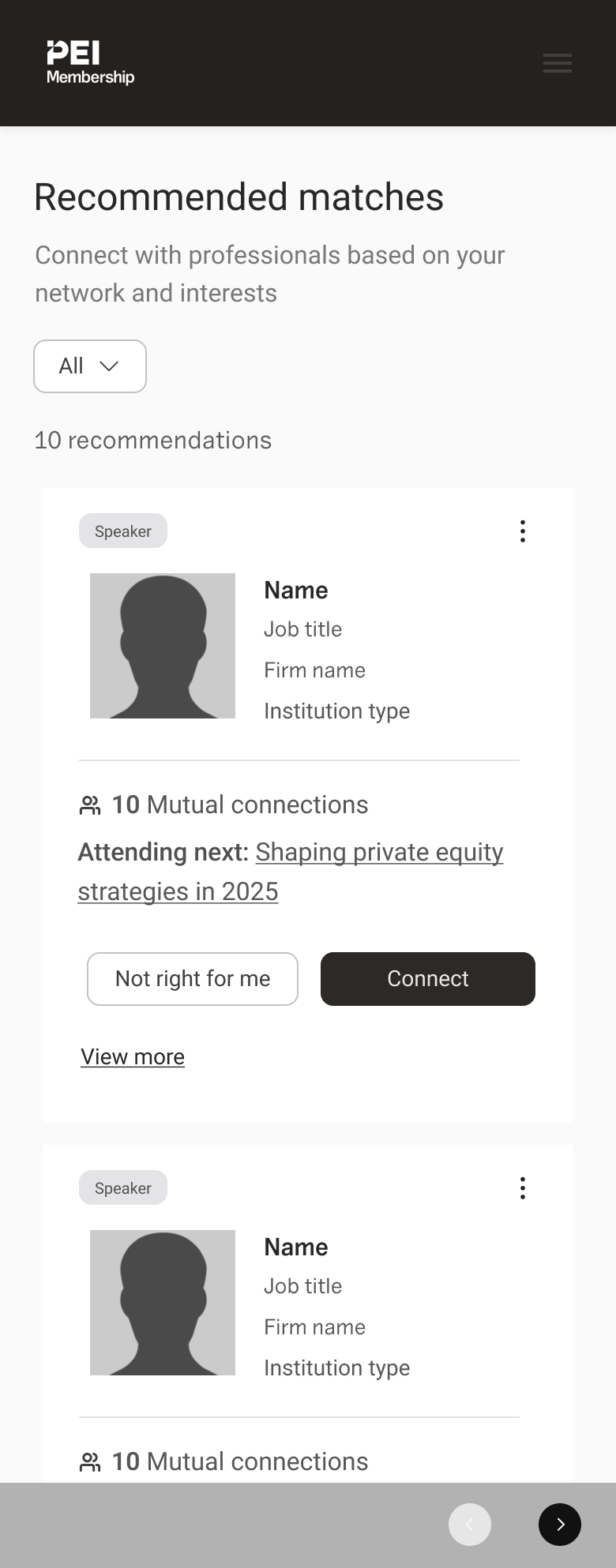

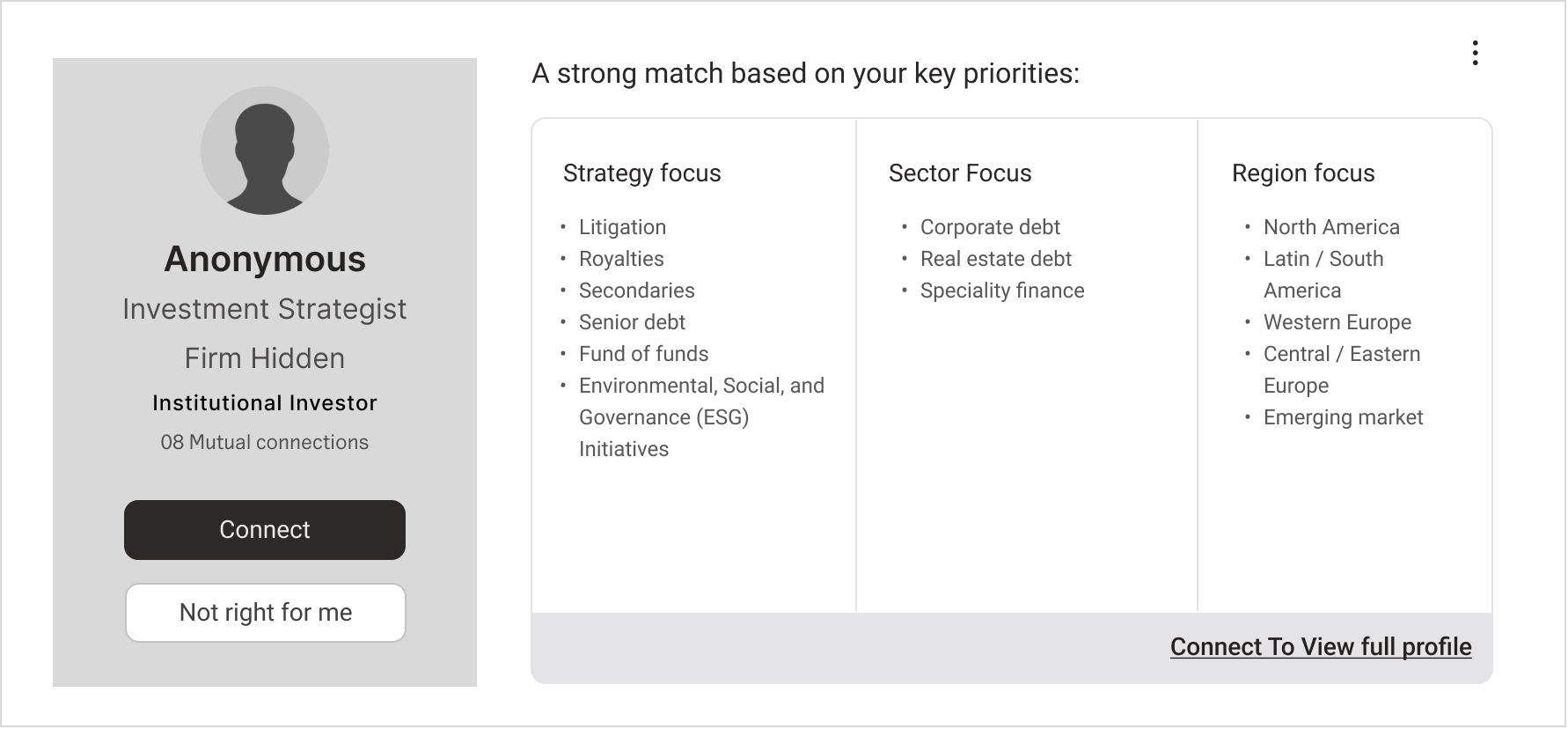

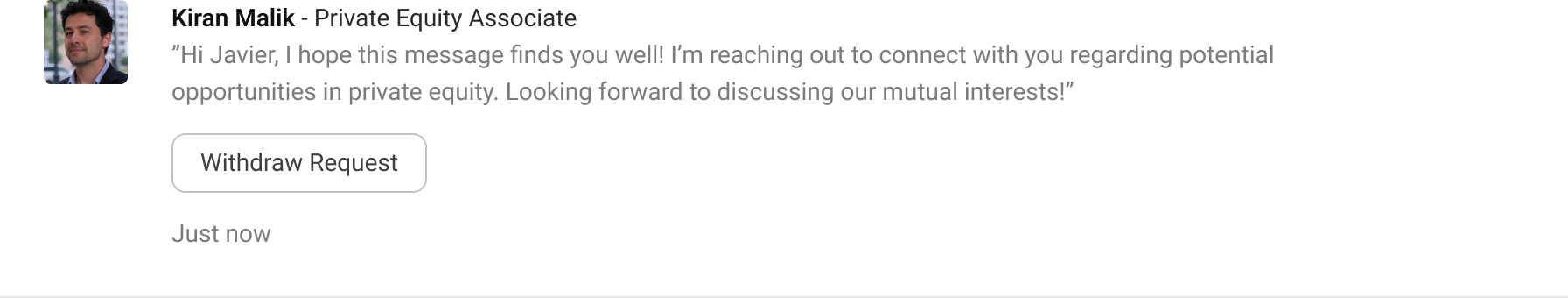

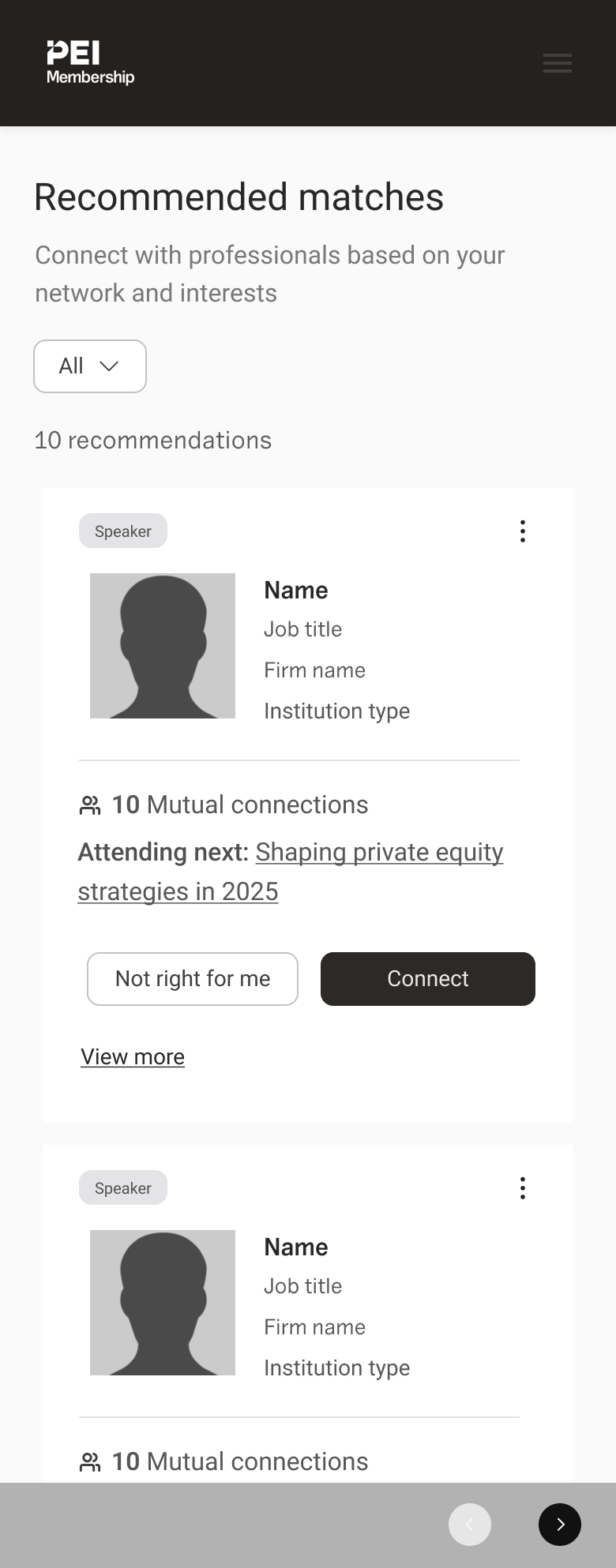

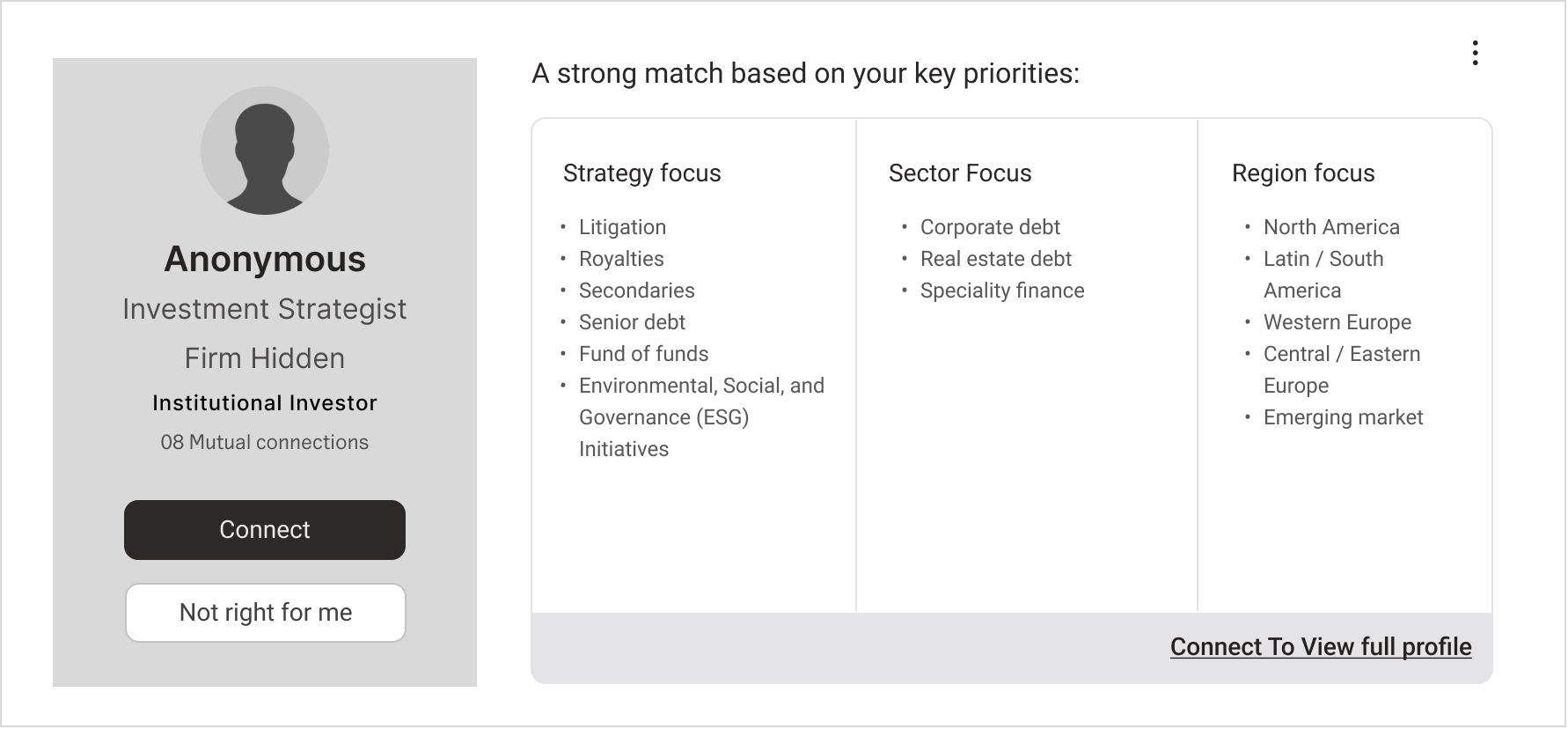

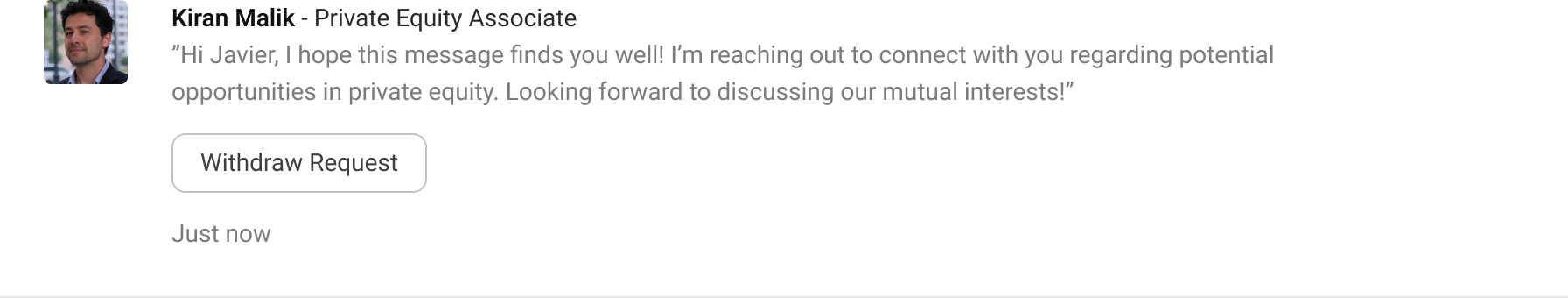

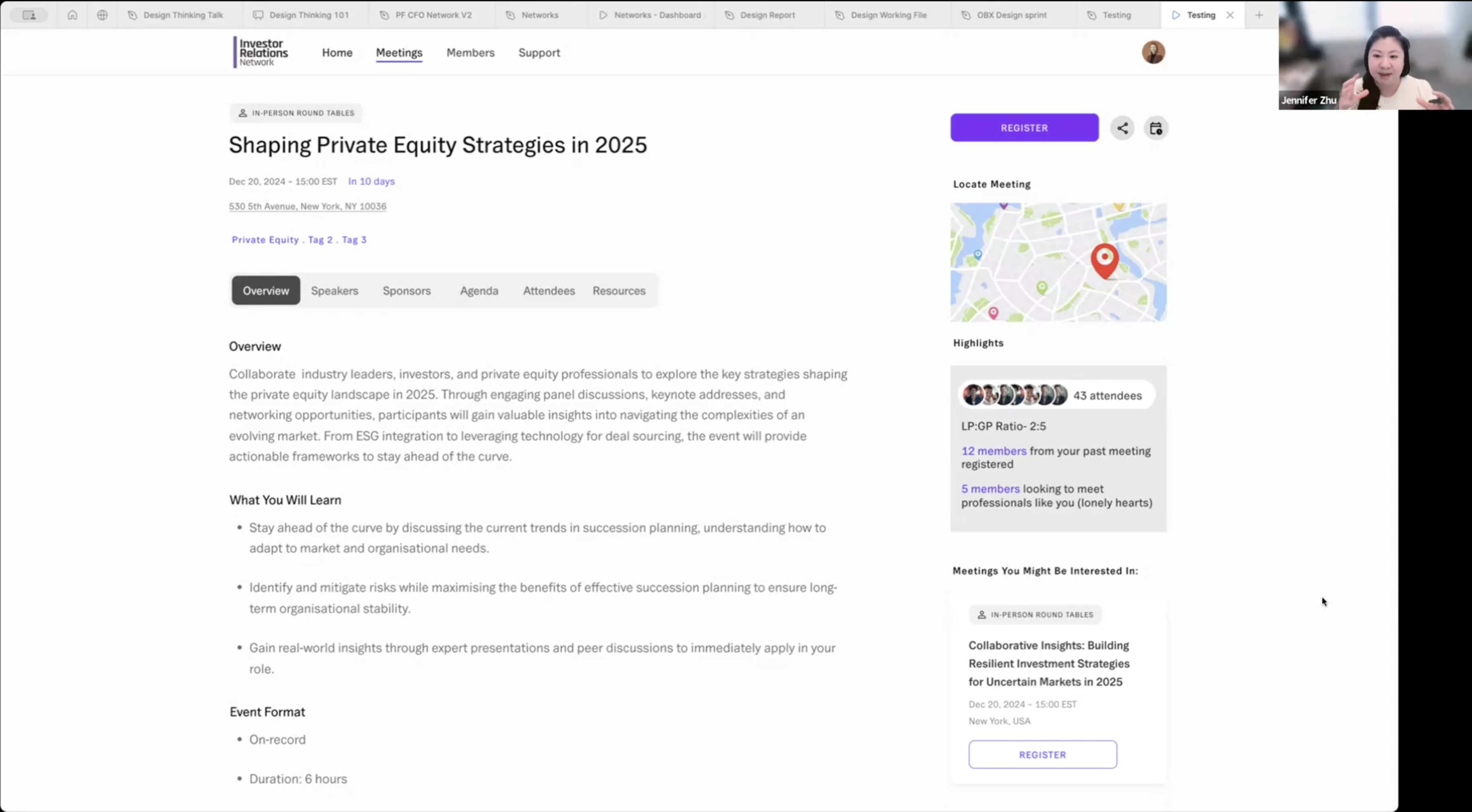

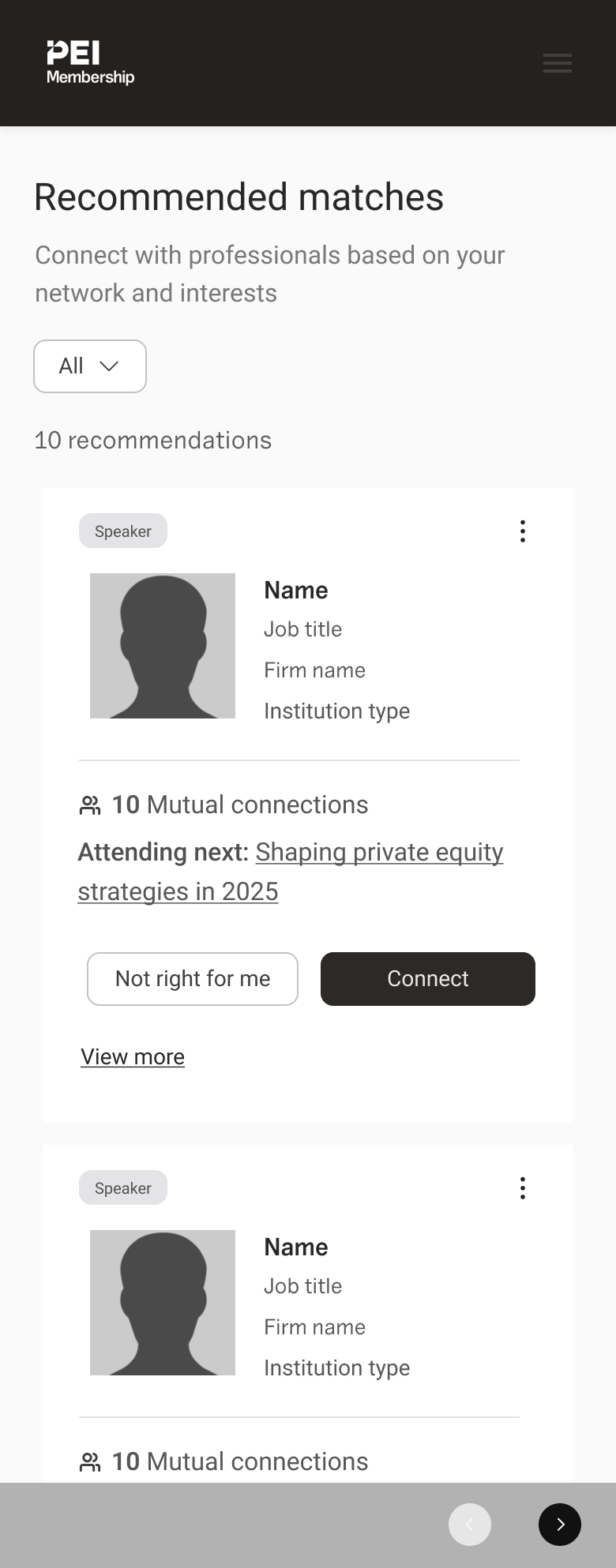

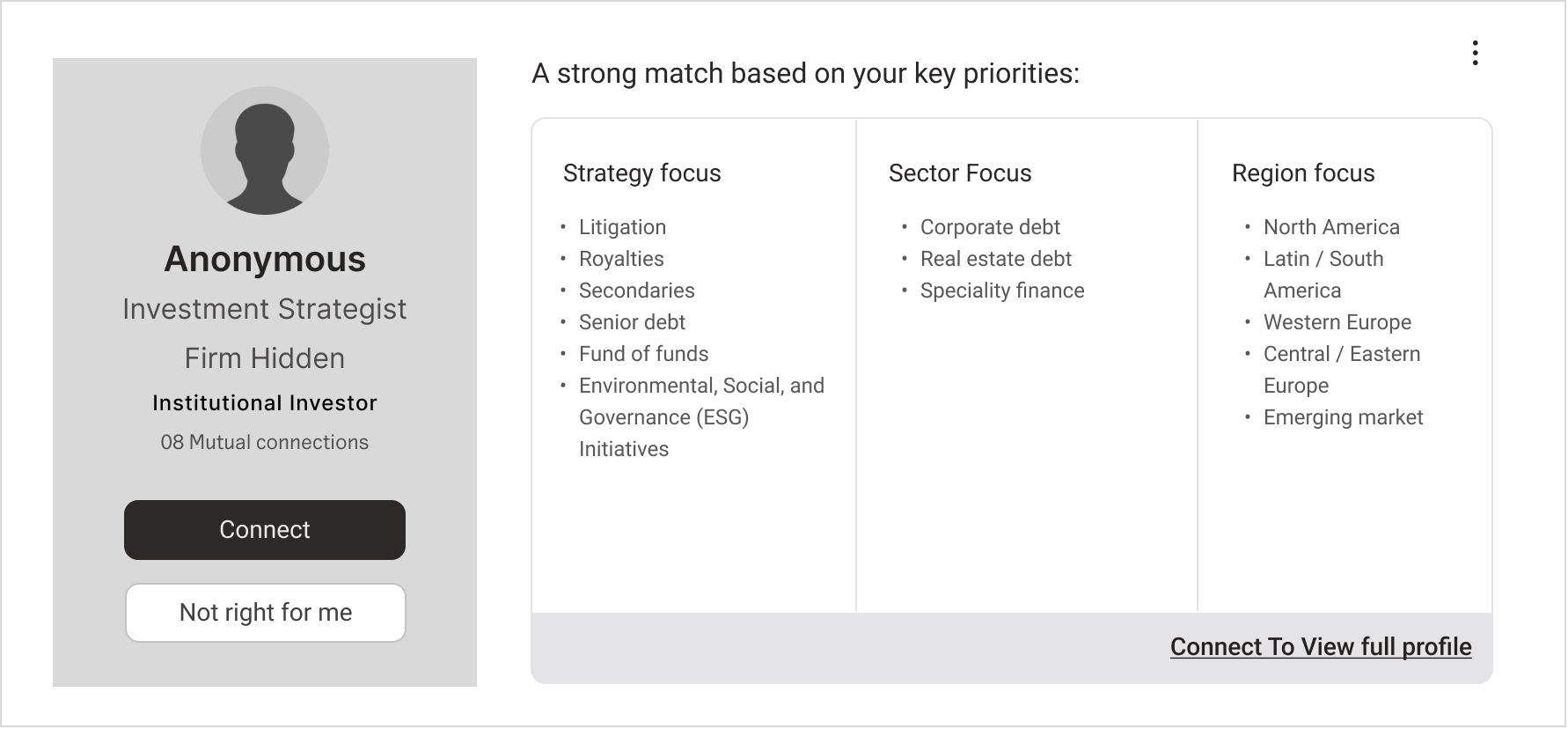

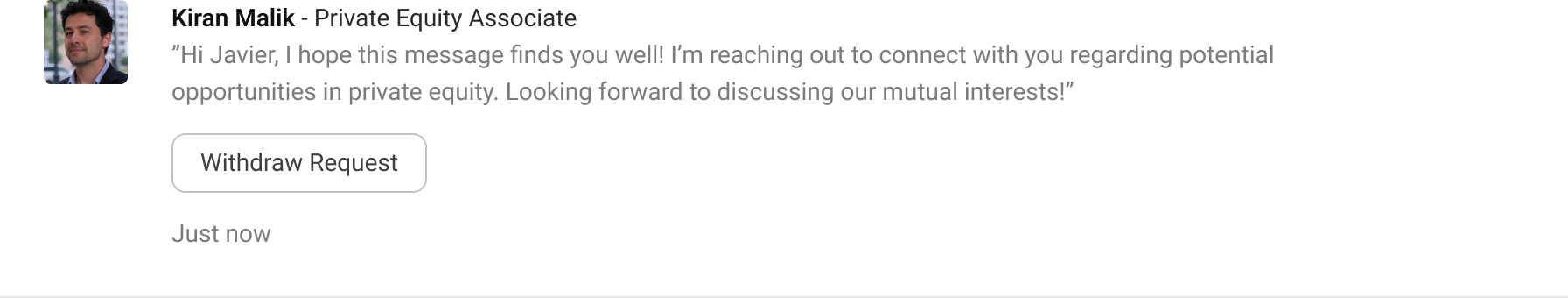

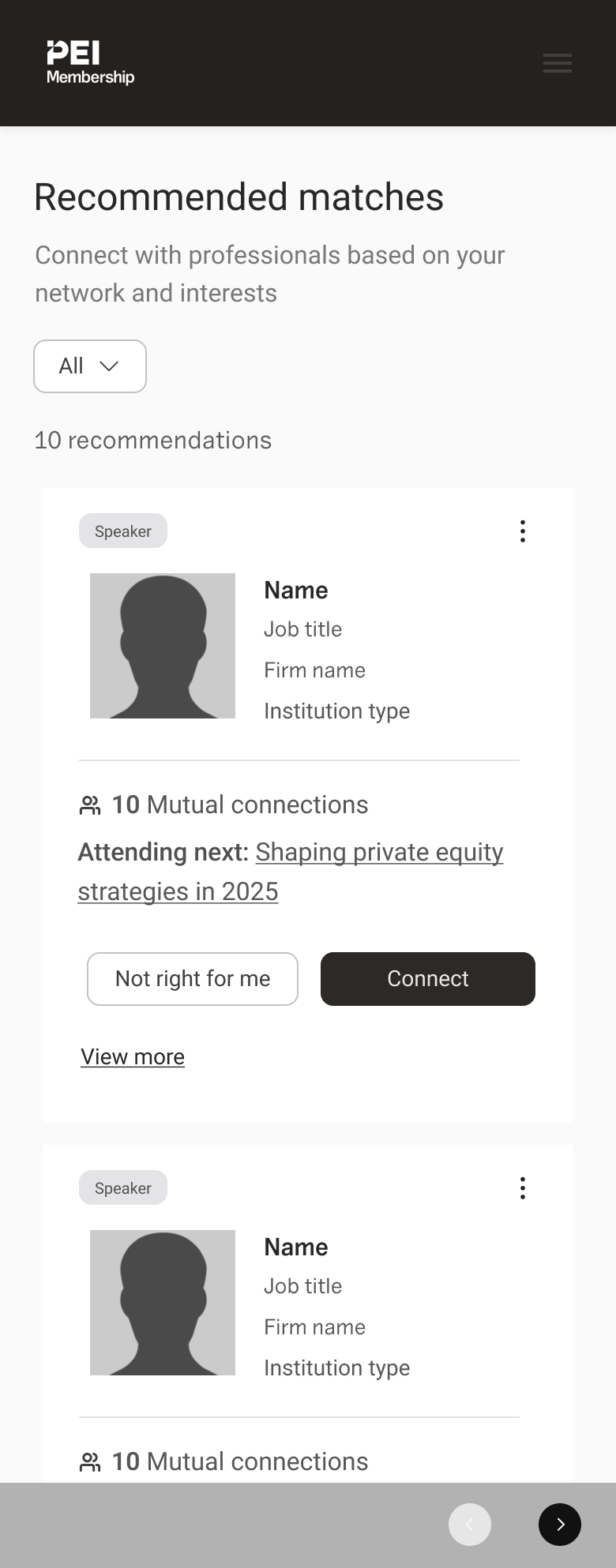

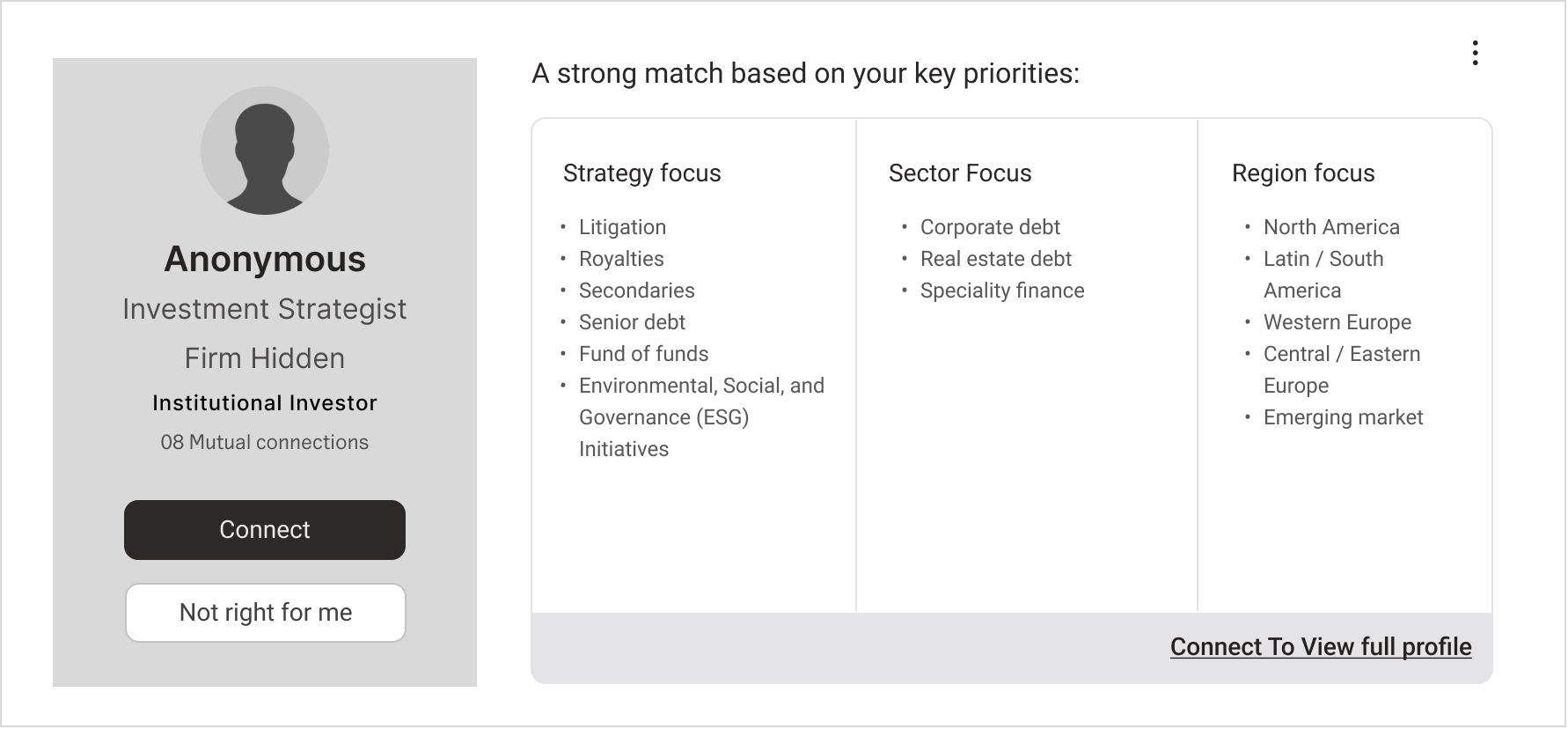

Snippets from wireframes showing recommendations, anonymous profiles and connection requests

Testing

To assess concepts at varying ranges of fidelity, I ran a series of moderated sessions with users, showcasing a series of clickable wireframes. These sessions set out to assess whether our latest designs satisfied key opportunities identified in research, while understanding user attitudes towards some of the more innovative features developed.

User Feedback Session

Key insights from testing

“If I can see why we match in one line, I will take the call.” - Investor

“An option to start without names makes it feel more about fit than company, or status.” - Institutional Investor

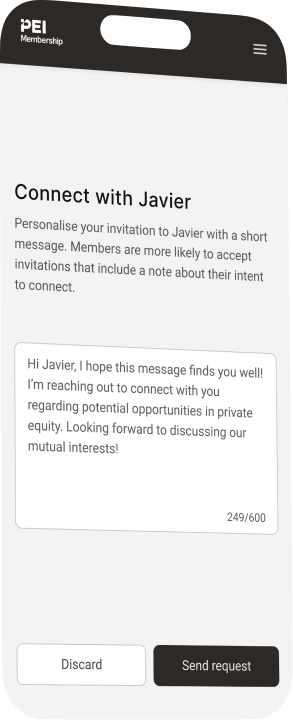

Sharing a short, personalised reason for sending a connection request was the strongest driver of engagement. Investors wanted to see why someone was connecting, before seeing their profile.

Anonymity made investors more willing share key strategy information more readily, in turn enabling fundraisers to better tailor communications approaches.

Different professional attributes (such as geographic or sector focus) are more important in driving connections than others. Investors need access to the most important information at a glance to drive effective decision making.

Solution

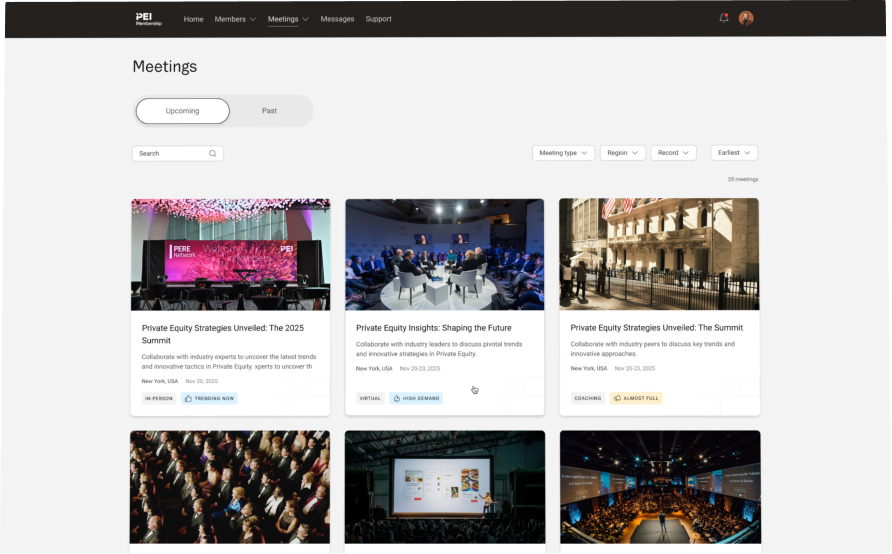

The final solution offered a digital networking experience to our network members, that directly supported our existing events ecosystem.

Using the platform, users can register to upcoming events, view attendee profiles and connect with them prior to the event. Once connected, the members are free to chat, and arrange meetings either in or outside of our events.

Features were developed to ensure that connection requests and recommendations were highly personalised, to avoid ‘spam’ requests, and promote authentic and genuine connection between fundraisers and investors.

A final anonymity feature gave investors higher levels of confidence in using the platform, knowing that they retained control over their identity.

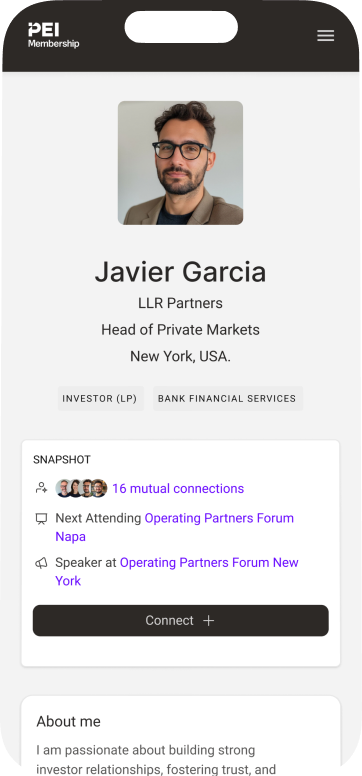

Final Mobile Designs

Impact

The platform launched for our New York Summit in 2025 with immediate, measurable adoption. Of the event's attendees, 250 built profiles and actively engaged with the platform. Most significantly, 140 in-person meetings were arranged directly through the app, demonstrating that the tool genuinely enhanced the event experience rather than simply adding a digital layer. Users connected before, during, and after the conference, validating the core hypothesis that attendees valued year-round engagement.

Qualitative feedback reinforced the quantitative success. One attendee shared: "I met three new contacts through the app before I even set foot in New York. It made the event twice as valuable." This sentiment was echoed across user feedback, with professionals appreciating the ability to maximise their conference investment through advance preparation and post-event follow-up. The research-driven approach to feature prioritisation proved effective, with users engaging primarily with the capabilities we'd identified as highest value during the discovery phase.

Beyond the immediate launch metrics, this project established a foundation for scaling PEI's digital community strategy. The MVP validated market demand, demonstrated technical feasibility, and provided a clear roadmap for feature enhancement based on real-world usage data. It represented a strategic shift from event-centric to membership-focused business model, with research insights directly informing product decisions and ensuring user needs remained central throughout development and launch.

Connecting Investors, All year Round

PEI connects investors and fundraisers through conferences and events that run across the year. This project was an opportunity to extend that value into a continuous digital experience that helps members find the right people at the right time.

I led the research as well as creating and testing flows with investors and fundraisers. Insights from those sessions shaped the final product direction and informed key experience choices around trust, privacy, and the quality of matches.

Product

Investor Relations Networking Platform

Skills

Research, Wireframing, User Testing

Role

Research Lead & Concept Designer

Timeline

3 Months

Research Planning

Before speaking with members, I aligned with product, commercial, and editorial leads to clarify business goals and constraints. We reviewed existing feedback, support tickets, and engagement data to build a shared view of the most valuable unknowns. From this, I wrote a learning plan and an interview guide focused on decision moments, signals of trust, and measures of fit.

Working with internal stakeholders to uncover research requirements

Discovery

Using the plan created alongside business stakeholders, I set out to perform exploratory research to better understand the problem space.

I began with field research at PEI events, conducting interviews with attendees to understand their needs before, during, and after conferences. These conversations revealed a consistent pattern: professionals highly valued the networking opportunities but felt frustrated when connections couldn't be maintained once they returned to their day to day work. One investor participant captured this sentiment perfectly: "The event is so valuable, but it feels like it all disappears once I leave the venue."

To further my in person research, I ran remote interviews with more investors and with fundraisers. Sessions focused on recent digital networking and matchmaking experiences, exploring what prompted outreach, what signalled quality, and what caused people to disengage. This allowed me to dig deeper, understanding the attitudes behind some of the behaviours captured from the events.

Key Insights:

Fit needs to be crystal clear before meetings are booked. Currently many networking apps revolve around a meeting being the first step. Investors need to see clear alignment in strategy, fund stage and geography before proceeding.

Matchmaking Fit

Volume is the core problem for investors. many are overwhelmed by outreach. They still want introductions, but they need a clear reason to engage.

Inbox Overwhelm

Privacy and control increase trust for investors. They want to share information progressively as they see appropriate to protect their investment strategy. This is a challenge for fundraisers who rely on such information to inform tailored outreach.

Privacy & Control

“There’s no such thing as a ‘re-up’ anymore, you have to earn it every single time” - Fundraiser

“Only occasionally do I feel that fundraisers do a good job of understanding us... are we a ticket, or are we a partner?” - Institutional Investor

Unpacking user attitudes, and mapping current experiences

Ideation

To begin the ideation phase, I outlined some design principles based on research findings. These helped to guide ideation, and internally assess the merits and pitfalls of different approaches.

Design principles:

With these principles in mind, early exploration involved mapping potential new journey flows based on the opportunities identified within research. These included processes to protect investors from being bombarded with connection requests from fundraisers who don’t match their investment strategy, and designing a recommendation engine to proactively ‘match’ network members based on their business goals.

FLOWS

We then started to examine how different components could be integrated to support the flows outlined.

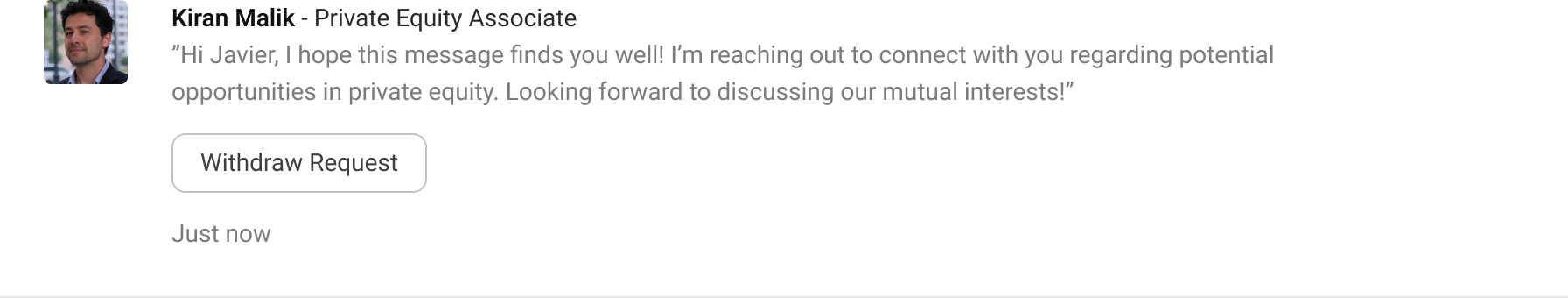

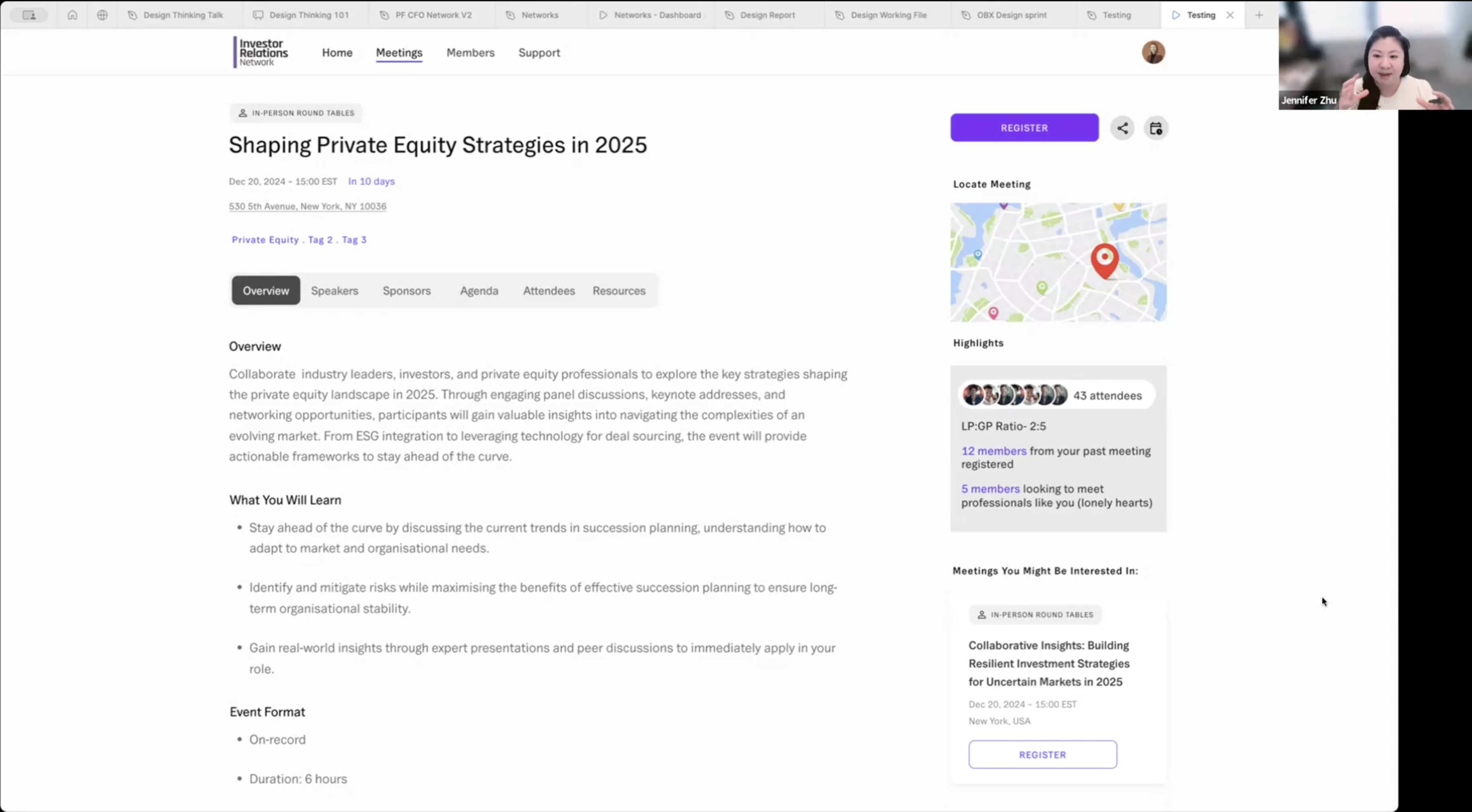

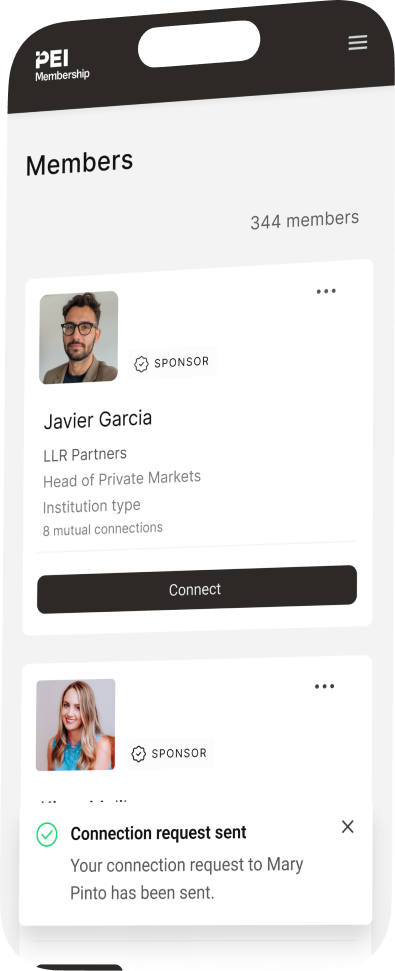

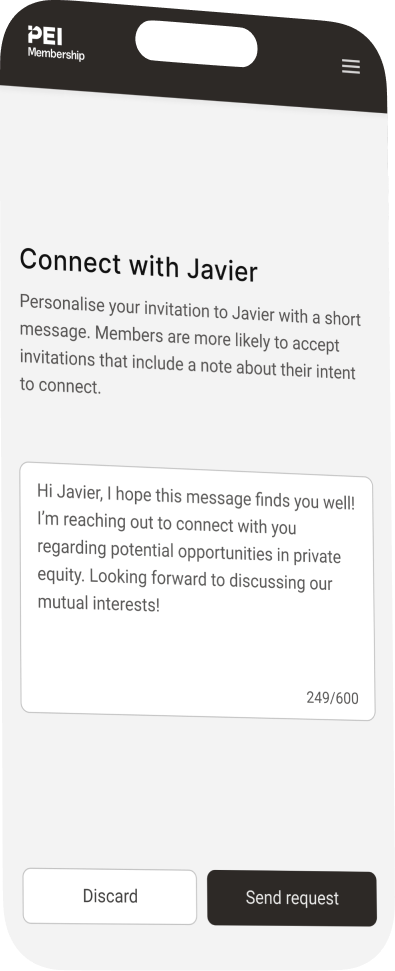

Snippets from wireframes showing recommendations, anonymous profiles and connection requests

Testing

To assess concepts at varying ranges of fidelity, I ran a series of moderated sessions with users, showcasing a series of clickable wireframes. These sessions set out to assess whether our latest designs satisfied key opportunities identified in research, while understanding user attitudes towards some of the more innovative features developed.

User Feedback Session

Key insights from testing

“If I can see why we match in one line, I will take the call.” - Investor

“An option to start without names makes it feel more about fit than company, or status.” - Institutional Investor

1

Sharing a short, personalised reason for sending a connection request was the strongest driver of engagement. Investors wanted to see why someone was connecting, before seeing their profile.

2

Anonymity made investors more willing share key strategy information more readily, in turn enabling fundraisers to better tailor communications approaches.

3

Different professional attributes (such as geographic or sector focus) are more important in driving connections than others. Investors need access to the most important information at a glance to drive effective decision making.

Solution

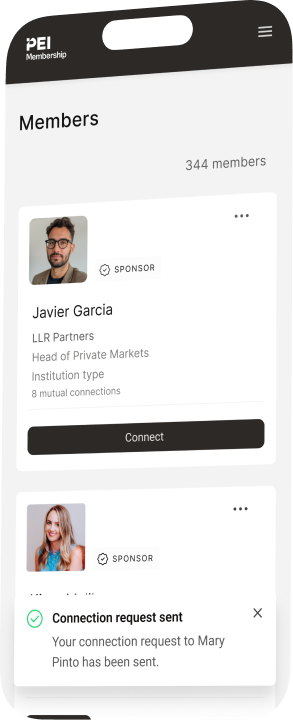

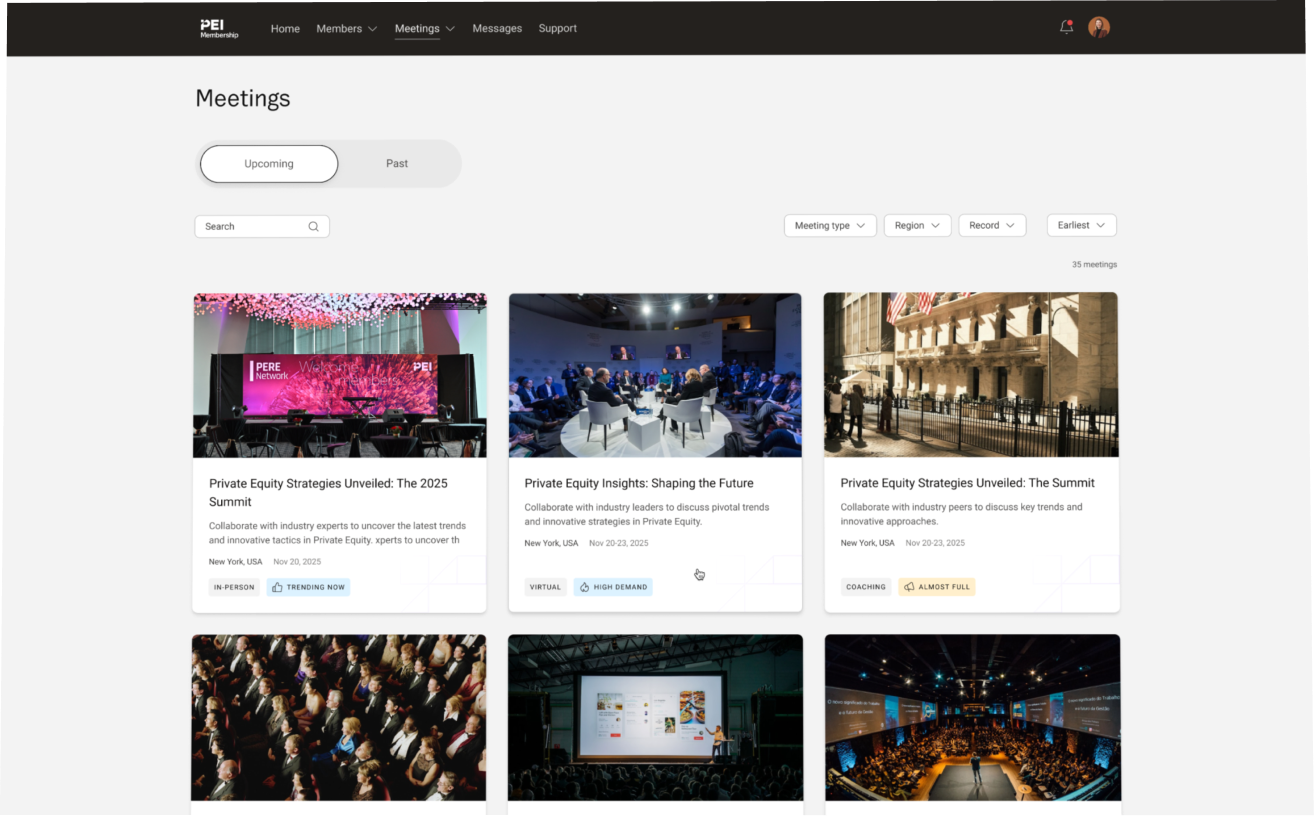

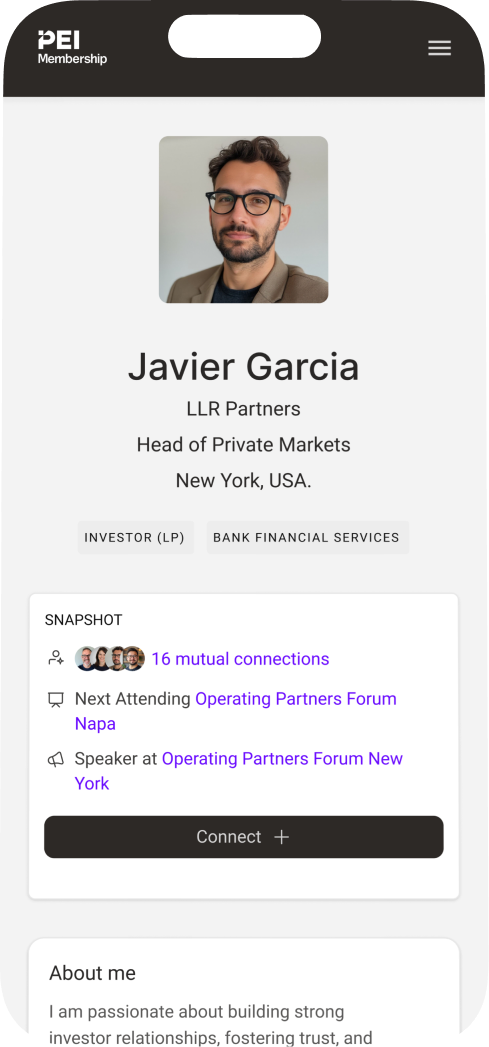

The final solution offered a digital networking experience to our network members, that directly supported our existing events ecosystem.

Using the platform, users can register to upcoming events, view attendee profiles and connect with them prior to the event. Once connected, the members are free to chat, and arrange meetings either in or outside of our events.

Features were developed to ensure that connection requests and recommendations were highly personalised, to avoid ‘spam’ requests, and promote authentic and genuine connection between fundraisers and investors.

A final anonymity feature gave investors higher levels of confidence in using the platform, knowing that they retained control over their identity.

Final Mobile Designs

Impact

The platform launched for our New York Summit in 2025 with immediate, measurable adoption. Of the event's attendees, 250 built profiles and actively engaged with the platform. Most significantly, 140 in-person meetings were arranged directly through the app, demonstrating that the tool genuinely enhanced the event experience rather than simply adding a digital layer. Users connected before, during, and after the conference, validating the core hypothesis that attendees valued year-round engagement.

Qualitative feedback reinforced the quantitative success. One attendee shared: "I met three new contacts through the app before I even set foot in New York. It made the event twice as valuable." This sentiment was echoed across user feedback, with professionals appreciating the ability to maximise their conference investment through advance preparation and post-event follow-up. The research-driven approach to feature prioritisation proved effective, with users engaging primarily with the capabilities we'd identified as highest value during the discovery phase.

Beyond the immediate launch metrics, this project established a foundation for scaling PEI's digital community strategy. The MVP validated market demand, demonstrated technical feasibility, and provided a clear roadmap for feature enhancement based on real-world usage data. It represented a strategic shift from event-centric to membership-focused business model, with research insights directly informing product decisions and ensuring user needs remained central throughout development and launch.